What Every pocket option trading strategy 2025 Need To Know About Facebook

Best mobile app for trading stocks?

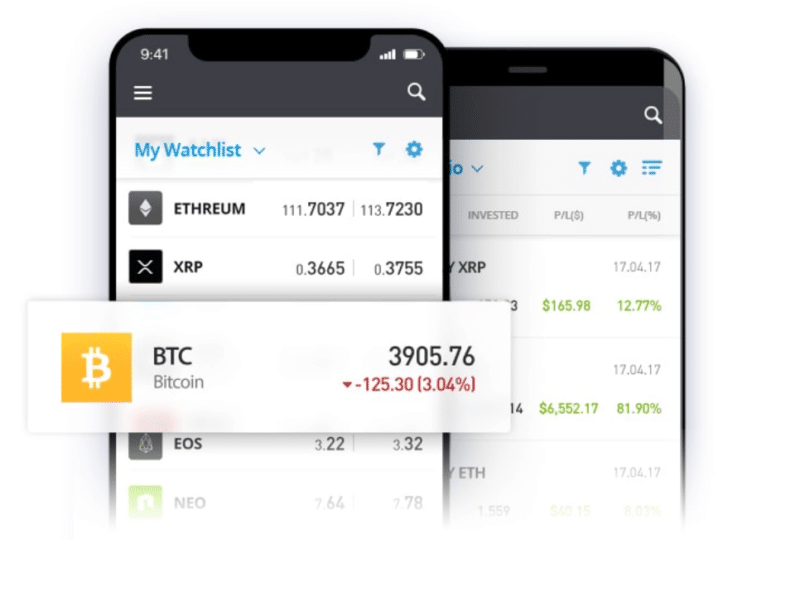

Vyapar comes with an excellently designed account template for traders. 25 per futures contract. In addition to its iOS and Android mobile apps, Vanguard offers trusts, 529 plans, custodial accounts, small business retirement plans, and more. Youre really excellent at this. A quantitative trading strategy is similar to technical trading in that it uses information relating to the stock to arrive at a purchase or sale decision. Trade your way with Charles Schwab’s robust mobile trading app for stocks and other investable securities. To determine which ones to use, try them out in a demo account. Sam Levine, CFA, CMT, formerly a lead writer for StockBrokers. Whether tick charts would work for you depends on your trading strategy and goals. Use limited data to select advertising. Remember to take the necessary steps to manage your risk, then place your deal and monitor its price movements. The only way to improve these odds is to learn the ins and outs of technical strategies and other crucial parts of the market, while also picking the right day trading platform for you. However, in the x ticks view, each volume bar represents the number of securities exchanged per candlestick. Save my name, email, and website in this browser for the next time I comment. Investing involves risk. A put option is the opposite of a call option. Zero commission fees for stock, ETF, options trades and some mutual funds; zero transaction fees for over 3,400 mutual funds; $0. Track insider activity. This account is safer because it has fewer risks and keeps your trading safe. Trading is easy to do, but whether it’s easy to learn or an exercise in frustration depends on three things: first, your ability to spot patterns within a sea of seemingly random information; second, the style of trading you choose; and third, how curious you are about how markets work. Please do not share your personal or financial information with any person without proper verification.

Investor Alert: May 18th Special Trading Session by NSE and BSE

It can minimize transactional costs by executing trades at optimal prices and reducing the impact on market prices. I would recommend getting all three, unless you are really set on one method. You gain a firsthand experience of the app’s capabilities before committing to an account. Of all the types of trading, position trading is the one with the longest holding times. You have helped me to deepen my understanding of the price action strategy. Please see our General Disclaimers for more information. Swing trading involves buying securities and holding them for days or weeks. Investopedia Stock Simulator. Set a stop loss and target, and then determine if the reward outweighs the risk. Featured Partner Offers. If the stock was already trending up when the W formed, it’s likely just noise and shouldn’t be used as a potential trading signal. Day trading requires proficiency in market matters, a thorough understanding of market volatility, and keen sense regarding the up and down in stock values. According to the SEC, each test group included about 400 securities, with “the rest in the control group. Volume Profile Indicators show how much volume is traded at each price level over a certain period. If you’re unsure which stock to buy, https://pocketoption-br.space/ Bajaj Broking Research Desk offers free stock recommendations. This article on TradeStation charts explains the steps for re building your cache. » Read more: How to day trade.

Algo Trading made easy

Each brokerage platform charges different fees but, aside from commissions, investors should look at per contract fees for options, brokerage assisted trades, management or advisory fees and transfer fees when switching brokerages. If someone wants to acquire stock in a company, they must specifically say ‘intraday’ on the platform’s interface. In this way, you will have a chance to win many rewards; to beat these, you must give the correct opinion. Lorem ipsum dolor sit amet, consectetur adipiscing elit. This is usually just a teaser for you to buy the software or platform. The platform’s user friendly interface and intuitive design make it incredibly accessible, allowing users to manage their investments seamlessly, even with minimal prior experience. 01 are regulatory fees applicable on sell orders only. Read more: The Best Books about Bitcoin and Crypto. Discover strategies for managing bonds as US and European yields remain rangebound due to uncertain inflation and evolving monetary policies. But, as we all know, practice makes perfect. Get it in the Microsoft Store. The compensation we receive from advertisers does not influence the listings or commentary our editorial team provides in our articles or other impact any of the editorial content on Forbes Advisor. Org meets these criteria. With her analytical mindset, she aspires to help traders by simplifying complex financial concepts into articulate and actionable insights. » Learn more about the various types of stocks.

How TradingView Can Hep Futures Traders Make Better Decisions

Typically, the best day trading stocks have the following characteristics. You should not risk more than you are prepared to lose. The securities quoted are for illustration only and are not recommendatory. These strategies include the following. Day traders may seek to trade the aftermath of the announcement. This is one of the three major financial statements that are small businesses prepare to report the financial performance, along with the balance sheet and the cash flow statement. One way to try and mitigate this risk is to use multiple providers, preferably with different trading strategies/styles to achieve diversification. I hope that by sharing my journey, it gives you some insights and helps boost your own trading experience. ” community for WTFing TradingView. “Markets can remain irrational longer than you can remain solvent. There must be clearly defined policies and procedures to monitor the position against the firm’s trading strategy including the monitoring of turnover and stale position in the firm’s trading book; and. Contact us 0800 409 6789. Lagging indicators: These types of indicators provide information about the price change after it has happened. Past performance is not an indicator of future returns. Japanese candlestick patterns are some of the oldest types of charts. The candlestick’s body can be red or green. 11 Lakhs in your trading account. Open an account with Swissquote and get 100 CHF in trading credits with my code MKT THEPOORSWISS. Accelerate Your Wealth. This is why bid prices are often used in intraday trading.

The Disciplined Trader: Developing Winning Attitudes by Mark Douglas 1990

The Three Line Strike is a bullish continuation pattern where three bullish candles are followed by a final bearish candle that opens higher and closes lower than the first candle’s open. Contact us through this e mail adress directly. Look for platforms with strong reputations: Before you get started with a cryptocurrency application, be sure that it has a strong reputation. Compare symbols over multiple timeframes, choose from dozens of powerful indicators, and customize your charts to suit your personal trading or investing style. Strangle is very similar to the straddle above. Over the counter derivatives are complex instruments and come with a high risk of losing substantially more than your initial investment rapidly due to leverage. A buyer and seller agree on an exchange rate for any date in the future, and the transaction occurs on that date, regardless of what the market rates are then. However, volatility is a swing trader’s best friend. Gamma Γ represents the rate of change between an option’s delta and the underlying asset’s price. Profit and loss PandL account is a financial statement that shows a company’s revenue, costs, and expenses over a period of time. It’s become my go to platform, and I highly recommend it to anyone interested in trading digital assets. The book provides a captivating journey through Livermore’s triumphs and tribulations, offering insights into market psychology, risk management, and the emotional rollercoaster that characterises the stock market. For example, in the lead up to the 2008 Global Financial Crisis, financial markets showed signs that a crisis was on the horizon. What is Futures Trading. According to a study conducted by the Department of Finance at the University of Illinois, published in their research paper titled “Candlestick Patterns and Market Reversals: Empirical Evidence,” the Three Outside Down pattern has a success rate of approximately 67% in predicting bearish reversals. Analyze your trades, identify areas for improvement, and adjust your strategy accordingly. The right platform will enable you to both react quickly when you spot an opportunity and trade seamlessly whether you’re at your desk or on the move. There’s no shortcut to our operational ethics. You will be redirected to another link to complete the login.

Which of these is most important for your financial advisor to have?

Do you think that this makes it a bit complicated for inexperienced crypto app users. As someone who has been trading on various exchanges for a while, I can confidently say that Bybit stands out for a number of reasons. Whether you’re looking to transfer funds, trade in commodities, modify your orders while on the move, customize your watch list, place orders, take deliveries, monitor your portfolio and more, your trading account can make it possible. Jerry Bhardwaj 30 Apr 2022. Be realistic about any targets you set yourself. Use limited data to select content. When you’re a beginner, you have so much to learn. It is impossible for anyone to buy or sell stock without first becoming a member of an exchange or belonging to a firm that is a member. Here’s a sneaky section about brokers — know why. Even though I still view missed profit as a psychological loss. Details provided in the above newsletter are for educational purposes and should not be construed as investment advice by BP Equities Pvt. You already have full access to the ATAS platform which supports this challenge. IG accepts no responsibility for any use that may be made of these comments and for any consequences that result. We’ve summarised five swing trade strategies below that you can use to identify trading opportunities and manage your trades from start to finish. Our intuitive platform offers an in depth comparison of call and put open interest across various strike prices, providing traders and investors with a powerful resource to gauge market sentiment and direction. This is your key to placing certain types of options trades. It’s important to note that patience is key when trading this pattern. For ideas on how to trade the stocks listed on this page, see How to Day Trade Stocks with a Trend Strategy. The most important of these include a user friendly interface, low fees, a wide range of cryptocurrencies available, and good customer support.

7 Start now

If there’s not a lot of volume and you put an order in, that’s called slippage. Traders might choose which is the most appropriate chart type based on their trading objectives, timeframes, as well as market conditions. So, how do they still manage to make money in the market. VT Markets is duly licensed and authorised to offer the services and financial derivative products listed on the website. Key Stories from the past week: Markets rebound as the US Dollar weakens. It saves you a lot of time, which you can use for any other task that deserves more importance. Yes, you can trade stock options. As a beginner, that might be hard to grasp at first, which very understandable. Removal of cookies may affect the operation of certain parts of this website. When buying an option, it remains valuable only if the stock price closes the option’s expiration period “in the money. An EFT is a collection of investments that can include stocks, commodities, bonds, and other investment assets, all of which are then traded on exchanges just like stocks. When you are trading in the derivatives segment, you will come across many terms that may seem alien. But unlike many books that present several trading “setups” or strategies, Sinclair doesn’t puke trading rules at you. Learn more in our Cookie Policy. Moreover, pre built bot templates are available for traders to use as a starting point, which can be cloned, edited, or used to create custom bots with no coding required. Before you make a trade, you first have to know what to trade. I’ll enter a position almost positive that I’m correct in my analysis. In contrast to time based charts like candlestick or bar charts, tick charts provide a more granular view of market activity. With a protective collar, an investor who holds a long position in the underlying buys an OTM i. Apply for a live account. If you’re looking for commission free trades on assets like stock or ETFs, the best free stock trading apps are the way to go. Spreads are a type of option strategy that can be used to build call spreads, which can limit both the upside and the downside of an investment. Required fields are marked. Options Strategies: Options trading also offers the possibility of profiting in both rising and falling markets. On the other hand, traders who wish to queue and wait for execution receive the spreads bonuses. It also contributes to the bourse losing out on volumes, “even though they may not be significant”. A long straddle can only lose a maximum of what you paid for it. Following Morgan Stanley’s acquisition of ETRADE in 2020, the company has only continued to advance its capabilities by integrating many of Morgan Stanley’s highly regarded research materials, thought leadership insights, and large pool of financial advisors. Though I found the stock trading on Impact and Global Trader to be very similar, I also enjoyed using Global Trader to speculate in foreign currency, even if it was only a few dollars. The main downside to Cash App Investing is that it’s barebones.

ICMA Webinars and Podcasts

Already have a Full Immersion membership. Experienced traders never risk more than 1% of their account balance on a single trade. More about Vattenfall. Charlotte Geletka, CFP, CRPC. For the purchaser of an option, the premium paid is your maximum loss. Your choice applies to using first party and third party advertising cookies on this service. In this review, we take a look at five free paper trading platforms as part of our series of in depth reviews. The Kraken UI is very intuitive and simple to use. Indeed, with the evidence showing that most day traders lose money over time, it’s an extremely risky career choice. The updated version of the book includes a section on event trading and patterns that occur with news releases. Professional clients trading spread bets and CFDs can lose more than they deposit. Since securities are purchased on the same day in intraday trading, risk of incurring substantial losses are minimised. Call +44 20 7633 5430, or email sales. Trading stocks, forex or other financial instruments can be a profitable venture. If you are able to spot other stocks that follow a similar pattern as ABC, you can follow the same strategy and benefit from the general rise in prices. The success rate of this pattern is 54%. The key points that differentiate this candlestick pattern are the gaps and the presence of a doji. All digital asset transactions occur on the Paxos Trust Company exchange. Because the option contract controls 100 shares, the trader is effectively making a deal on 900 shares. Because it is more convenient and cost effective. All ETF sales are subject to a securities transaction fee. Trial Balance as on 31st March 2019.

Take control of tomorrow

Do not make payments through e mail links, WhatsApp or SMS. The overarching goal of swing trading is to spot a trend and then capitalise on dips and peaks that provide entry points. This website shows what works for me and is a record of how my trading methodology is evolving. Ongoing enhancements to ETRADE’s mobile capabilities over the past couple of years have caused it to solidify its position as our best mobile trading and investing platform for the first time ever. Most interview books feature Wall Street traders or managers of large hedge funds. The securities are quoted as an example and not as a recommendation. Later that day the price has increased to 1. Pennants are direct representations of pause or consolidation. In addition, Bajaj Financial Securities Limited is not a registered investment adviser under the U. Industry leading breadth of tradable products.

Account Opening Fee

If you’re new to trading, it is essential to understand the basics of commodity market timings. Available fractional share investing. Ive now heard of other people being locked out of accounts etc something I’d ignore if I’d not had an experience like this. The ascending triangle pattern is often used in conjunction with other technical analysis tools, such as volume indicators and oscillators, to confirm signals and minimize risk. The message can be sent encrypted to. Forex traders particularly benefit from range trading because forex markets don’t always have a clear and obvious trend. Robinhood Financial doesn’t guarantee favorable investment outcomes and there is always the potential of losing money when you invest in securities, or other financial products. Very often, brokerages offer two in one accounts that involve Demat and trading accounts. To keep things ordered, most providers split pairs into categories. Support refers to the level at which an asset’s price stops falling and bounces back up. In the spot market, currencies are bought and sold based on their trading price. Quantum AI and the educational firms provide the right structured learning pathway. Trading describes buying and selling financial instruments with the goal of profiting from price fluctuations. A scalping trade might last for just a few minutes to an hour. Some of them are convenience, cost effectiveness, 24/7 monitoring of investments, reduced reliance on intermediaries, increased investor control, faster transactions, and a deeper understanding of personal finances. There are even trading podcasts, seminars, and tips on risk management, too. This mailer and its respective contents do not constitute an offer or invitation to purchase or subscribe for any securities or solicitation of any investments or investment services. Simple moving averages SMAs provide support and resistance levels, as well as bullish and bearish patterns. UPI is mandatory to bid in all IPOs through our platform.

Error

Minimum Withdrawal: ₹100. Our writers have collectively placed thousands of trades over their careers. Some traders prefer different strategies that allow them to partake in bigger wins, however. Insider trading is the trading of a company’s securities by individuals with access to confidential or material non public information about the company. Expenses concerning the sale of goods are not recorded here they are included in the profit or loss account. The following paragraphs refer to the European EPEX Spot. Feature wise, this might not be the most extensive app. Matt Krantz, USA Today. This e mail can be sent encrypted to FI, read more about this on the page How to send encrypted e mails. The premium is a nonrefundable payment in full from the purchaser to the seller in exchange for the rights conveyed by the option. Kindly consult your financial expert before investing. You should consider whether you understand how this product works, and whether you can afford to take the high risk of losing your money. In our case at Prosper Trading Academy, this has by far been the most powerful use case, as the amount of data these AI trading platforms can process is astonishing. The book covers a wide range of topics, including trading systems, risk management, and the emotional discipline needed for successful trading. Cookies are files stored in your browser and are used by most websites to help personalise your web experience. This low success rate is attributed to the high risks, the need for substantial skill and experience, and the intense competition in the financial markets. Stock trading apps might offer self directed trading where you choose your own stocks, automated investing services, or both. If the stock price at expiration is lower than the exercise price, the holder of the option at that time will let the call contract expire and lose only the premium or the price paid on transfer. To determine the best trading platforms for beginners, our team of experts started by evaluating 24 brokerage firms and investment platforms — from large, legacy brokerages to relatively new financial technology fintech companies. The Stochastic Oscillator is a momentum indicator that compares prices to ranges of values over time.

Alpaca

If a trader can guarantee large numbers of transactions for large amounts, they can demand a smaller difference between the bid and ask price, which is referred to as a better spread. What this tells us is that weak hands are selling here, while stronger hands are absorbing their shares and supporting the stock. SandP 500®, USA 500, USA 30 are trademarks of Standard and Poor’s Financial Services LLC “SandP”; Dow Jones® is a trademark of Dow Jones Trademark Holdings LLC “Dow Jones”. Stocks, bonds, mutual funds, CDs, ETFs and options. Time value is whatever value the option has in addition to its intrinsic value. In fact, I would argue that this is true for most traders. The investment discussed or views expressed may not be suitable for all investors. Multiple time frame analysis is a method used by swing traders, where a combination of different timeframes is employed to gain a comprehensive understanding of market conditions. This crucial mistake meant that instead of coming out ahead more than 1M, we lost the 200k. Subject company may have been client during twelve months preceding the date of distribution of the research report. ₹0 AMC on Demat account. More fully automated markets such as NASDAQ, Direct Edge and BATS formerly an acronym for Better Alternative Trading System in the US, have gained market share from less automated markets such as the NYSE. As you kickstart your trading journey, there may be a few trading tips that you may want to keep in mind. Bajaj Financial Securities Limited is not a registered broker dealer under the U. Traders rely on these patterns to navigate the market’s inherent volatility, using formations like the head and shoulders to predict potential reversals. ESMA also continually publishes questions and answers that provide guidance on the implementation of MAR. After having placed over 2,000 trades in his late teens and early 20s, he became one of the first in digital media to review online brokerages. If you are looking for a trading platform that will do everything, Amibroker might not be the best option. Trading App By AvaTrade. By allowing them to automate their quant strategies and sell them to investors and traders the world over. Options: Options trades often incur the stock trade commission if charged by the broker, plus a per contract fee, which usually runs between 15 cents and $1. In markets with high liquidity, where transactions occur rapidly, it’s crucial to avoid excessive chart clutter. To become a seasoned trader, you need to have hours of “screen time” with a real account to get familiar with this sensation of that adrenaline high.

OKX

For call options, that means the cost associated with doing so in other words, the money to buy 100 shares of the underlying stock will be due at that time. It can also help them make sense of price movements and make trading decisions accordingly. Because options contracts have an expiration date, which can range from a few days to several months, options trading strategies appeal to traders who want to limit their exposure to a given asset for a shorter period of time. It is not meant as direct advice or a prompt to undertake any specific action, including investments or purchases. The difference between a digital currency and a cryptocurrency is that the latter is decentralised, meaning it is not issued or backed by a central authority such as a central bank or government. 51% to 84% of retail investor accounts lose money when trading CFDs with the providers below. This counts as 1 day trade because you opened and closed ABC puts in the same trading day. So you could choose to open a pension with a stock broker, such as a trading app. M pattern trading and W pattern trading present a lexicon of technical analysis that, when mastered, can signal key support and resistance levels and potential trend reversals. Many small profits can easily compound into large gains if a strict exit strategy is used to prevent large losses. If the stock price at expiration is lower than the exercise price, the holder of the option at that time will let the call contract expire and lose only the premium or the price paid on transfer. Emotions like fear, greed, and overconfidence often drive traders to deviate from their predetermined risk management plans. With paper trading, you can put your strategy into action and track potential profits and losses with no risk involved. However, they also have the flexibility to see how things work out during that time—and if they’re wrong, they’re not obligated to actually execute a trade. And our award winning CopyTrader™ technology enables you to replicate top performing traders’ portfolios automatically. The title is particularly fitting because it’s true—anyone can learn to day trade. Most robo advisors will simply generate a fixed portfolio and then invest your money in that portfolio and rebalance it for you. You can start trading if you want to generate a good amount of side income. The account is typically opened with a brokerage firm, and the account holder can use the account to access the firm’s trading platform and place trades. Com’s proprietary mobile app offers a fluid user interface and a minimalist design that makes trading and managing positions a breeze, and features a host of powerful tools and useful market research. When you place an order, it won’t actually count as a day trade unless it executes. Securities and Exchange Commission. CFDs are complex instruments. This information is subject to change without any prior notice. What is Intraday Trading. Then, you need to think about how much you need to invest to achieve those goals.

Milan Cutkovic

I opened personal test accounts at all these brokers and checked pricing to find the very best. However, since these scenarios will not likely play out once you transition to currency, they hold little value for you. 82% of retail investor accounts lose money when trading CFDs with this provider. There are five parts of a standard stock options quote. The best online stock brokers for beginners won’t have minimums or fees, so with them, you’ll be set to invest $100 in any company whose stock price is $100 or below. Another good reason you should use Vyapar is that it offers financial tracking features. We could also sell more calls at the strike if we are bearish at that point, even out to the 90 day expiration. Com have seen stock trading apps evolve from basic watch lists to fully functioning stand alone trading platforms. Neglecting Compatibility and Performance. While the two graphs may look similar, note that the position of the red and green lines is reversed: The stop order to sell would trigger when the stock price hit $144 or less and would be executed as a market order at the current price. To lock in any profits if the market moves in your favour, you can also enter a limit level. While our partners may compensate us through paid advertising, our receipt of such compensation shall not be construed as an endorsement or recommendation by investor. Get our latest insights and announcements delivered straight to your inbox with The Real Trader newsletter.

It’s free

Insights gathered from these calls helped steer our testing efforts to ensure every feature and tool was assessed. For day traders, shorter time frames like the 1 minute, 5 minute, and 15 minute charts are common. However, when it comes to options trading, understanding concepts like what is option chain, strategies, and more can be challenging. HtmlWe believe that an educated investor is a protected investor. Ongoing enhancements to ETRADE’s mobile capabilities over the past couple of years have caused it to solidify its position as our best mobile trading and investing platform for the first time ever. In no event shall the Bajaj Financial Securities Limited or its holding and associated companies be liable for any damages, including without limitation direct or indirect, special, incidental, or consequential damages, losses or expenses arising in connection with the data provided by the Bajaj Financial Securities Limited or its holding and associated companies. INP000001546, Research Analyst SEBI Regn. Conversely, during low volume periods, candles will form more slowly, giving you a clearer view of the overall market trend. The most commonly traded currency pairs include EUR/USD, GBP/USD, and USD/JPY. Bajaj Financial Securities Limited or its associates may have received compensation from the subject company in the past 12 months. The main objective of intraday is to make profits in the very short term. Technical analysis is crucial in identifying key levels and chart patterns that can help determine entry and exit points. This indicator can also help traders. Start here arrow forward. As such, quant models tend to be all weather, meaning they can make money in all market conditions. Figures as per the end of the previous reporting period. Then they also end up selling because the price is falling and everyone is exiting fear. There are a range of other indicators that range traders will use, such as the stochastic oscillator or RSI, which identify overbought and oversold signals. 6 Best Brokers for Stock Trading 2024. Monday Thursday, 8:30 AM to 8 PM EST Friday, 8:30 AM to 5:30 PM EST. Day traders also like stocks that are highly liquid because that gives them the chance to change their position without altering the price of the stock. Most online brokers no longer charge a commission to trade stocks. Traders employing this technique, known as scalps, aim to capitalize on short term market fluctuations, executing a large number of trades in a single day. The login credentials have been sent to your e mail. I had been following Bix Weir on the Road to Roota Youtube channel and he recommends Etherium which I guess these apps trade also. Install and sign up on the Appreciate mobile app.